Background

This document lays out the main workforce management scenarios that face our clients as they manage their workforce during the Covid-19 Pandemic, as well as financial support resources for both Employees and Employers. We know that these decisions have major financial and operational implications of all of these decisions and that you will rely on other internal and external experts for help - in particular, your accountant.

This document is intended to be a starting point for discussion between Owners and Managers of our clients, and us here at WorkforceWins. Do not share this document widely or without due consideration.

Workforce Management Scenarios

Below is a summary of the six workforce management scenarios we see and the options for managing employee missed wages and / or supporting your wage costs as an employer.

1. An Employee misses work due to reasonable risk of exposure

Employee Missed Wages: They can use company paid sick days, ought to be given access to any unused vacation, banked or lieu time. The Employee ought to be eligible for one of EI or CERB.

Employer Wage Costs: n/a

2. An Employee misses work because they are diagnosed with Covid-19

Employee Missed Wages: They can use company paid sick days, ought to be given access to any unused vacation, banked or lieu time. The Employee ought to be eligible for one of EI or CERB.

Employer Wage Costs: n/a

3. An Employee misses work because the company has elected to scale down operations.

Employee Missed Wages: They can use company paid sick days, ought to be given access to any unused vacation, banked or lieu time. The Employee ought to be eligible for one of EI or CERB.

Employer Wage Costs: 10% and 75% wage subsidy, EI work share.

5. An Employee misses work because the company has been required to scale down operations (by internal decision or government decree)

Employee Missed Wages: They can use company paid sick days, ought to be given access to any unused vacation, banked or lieu time. The Employee ought to be eligible for one of EI or CERB.

Employer Wage Costs: 10% and 75% subsidy, EI work share.

4. An Employee misses work because they need to care for a child/children whose school or day care is closed.

Employee Missed Wages: They can use company paid sick days, ought to be given access to any unused vacation, banked or lieu time. The Employee ought to be eligible for one of EI or CERB.

Employer Wage Costs: n/a

6. An Employee misses work because they refuse to work due to a real or perceived risk related to Coronavirus.

Employee Missed Wages: The treatment of such time away depends on, among other things, whether the Employee can work remotely and whether the company is an essential service. Contact us to discuss.

Employer Wage Costs: n/a

Options are Available to Support Employee Lost Wages

1. Canada Employment Relief Benefit (CERB)

What we know:

- $2000 (taxable) monthly for up to 16 weeks, retro to March 15 (but will cover situations that occur up to October 3).

- To qualify must have an income of at least $5000 in the preceding 12 months (does not have to be EI eligible).

- Must be at least 15 years old, a resident of Canada and “ceased work for reasons related to COVID-19” for 14 days.

- Not yet on EI (or you are ineligible for EI).

- Applications will be made through CRA’s MyAccount portal, beginning April 6.

- (EI eligible) Employees who use up their CERB benefits and remain unemployed, will still be eligible for EI (if needed) after using their 4 months of CERB benefits.

What we don’t know:

- Can you work part-time while on CERB?

- Can employers top-up CERB?

- Will it be retroactively means tested at some point in the future?

2. Employment Insurance (EI)

- Likely payable back to day one.

- No change to R12 hours worked requirements.

- No change to maximum benefits or max duration calculations.

How EI Works in Normal Situations and Times?

- It is normally payable retroactive to one week after last date of employment.

- EI pays 55% of an employees wages to a maximum of $573 per week.

- You can receive EI for 14 to 45 weeks depending on your region.

- In normal circumstances it takes in the range of 4 weeks to receive the first payment.

- In normal circumstances, Employees need to work a minimum number of hours in a 52-week period to be eligible for EI benefits. To receive sickness benefits, workers need 600 hours — for regular EI it ranges from 420 to 700 hours, depending on the employment conditions in your area.

https://www.canada.ca/en/services/benefits/ei.html

3. EI Workshare Program

- This is available for workers who agree to reduce their normal working hours. Example: if you reduce an employee’s hours to part time (3 days/week) EI will pick up the remaining 2 days and top off wages. Employee must be EI eligible and agree to this arrangement

- You can lay off (part time) departments, individual employees or all employees

- The government has indicated it will ease the otherwise fairly stringent eligibility requirements and will simplify the application process.

- Business activity levels must have dropped by 10%

- Cannot be part of EI Workshare Program and Wage Subsidy at the same time.

- Maximum duration of Workshare arrangement has been increased to 76 weeks (Wage subsidy 16 weeks)

Options Available to Support Employer Wage Costs

1. Canada Emergency Wage Subsidy (CEWS)

- The subsidy is 75% of the first $58,700 normally earned by an employee, representing a maximum benefit of $847 per week.

- The program will be in place for a 12-week period, from March 15 to June 6, 2020.

- Eligible employers who suffer a drop in gross revenues of at least 15 percent in March, and 30% April or May would be able to access the subsidy.

- Eligible employers include employers of all sizes and across all sectors of the economy, with the exception of public sector entities.

- This wage subsidy will be based entirely on the salary or wages actually paid to employees.

- All employers will be expected to at least make best efforts to top up salaries to 100% of the maximum wages covered.

- Application will be made through a Canada Revenue Agency online portal.

- Consequences for those who don't manage it in good faith - the reduction in business will need to be proved down the line. It's possible folks with less than the 15% or 30% may just have their original subsidy pro-rated and some owed back.

- Special rules will potentially limit the subsidy available in relation to employees who do not deal at arms’ length with the employer.

- Any wage subsidies will be taxable to the employer receiving them.

- Available mid-May 2020.

- See the section below for Considerations for Managing CEWS.

- CRA also announced that they expect to open the application process on April 27, 2020 through My Business Account or a separate online application form.

https://www.canada.ca/en/department-finance/news/2020/04/the-canada-emergency-wage-subsidy.html

Calculate your Subsidy Amount: https://www.canada.ca/en/revenue-agency/services/subsidy/emergency-wage-subsidy/cews-calculate-subsidy-amount.html

2. Temporary Wage Subsidy Program (10%)

- The 10% will apply to remuneration paid from March 18 to before June 20, 2020, up to a maximum subsidy of $1,375 per employee and $25,000 per employer.

- An eligible employer must employ one or more individuals in Canada and had to have been registered with a business number and a payroll remittance account on March 18, 2020.

- Eligible employers can immediately benefit from this subsidy by reducing their remittances of income tax withheld from their employees’ remuneration. This reduction does not apply to CPP or EI remittances.

- Companies can avoid the payroll machinations and have it paid out to them by the CRA at the end of the year - if they don't need the small boost in cash flow right away.

3. Other Options

EI Sub-plan

- Employees do not attend work at all yet you contribute to their wages (versus work share where you contribute wages but still have the use of the employee).

- Approval required by government, longer application process.

Non-EI Workshare Program

- An agreement with workers to reduce their schedules (and pay) by up to 20%.

- No application process required.

Informal Hours Banking

- It represents a skirting of EI program rules (and likely rules of these new programs).

Considerations for Managing CEWS

Should you call back employees based on the government’s promise that they will pay you back via this program?

This is one of the challenges some of our clients are struggling with – especially when employees ask if and when they will be called back based on what they’ve heard of the program.

Until the program application process opens (mid to late May) and you successfully apply and qualify, there is some risk that you would have made those outlays in vain. It is up to your personal judgement.

How to schedule employees to work within (or as close as possible to) the max CEWS benefit per Employee?

This may not be a priority but if it is, here are some ideas:

- Create a custom weekly default number of hours per employee based on their regular wage, the max earnings on CEWS and their pre-pandemic earning (as calculated per the program criteria).

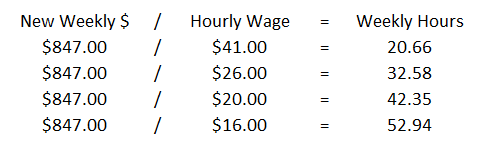

- If pre-pandemic pay is above $847 per week, then schedule them with the max hours below:

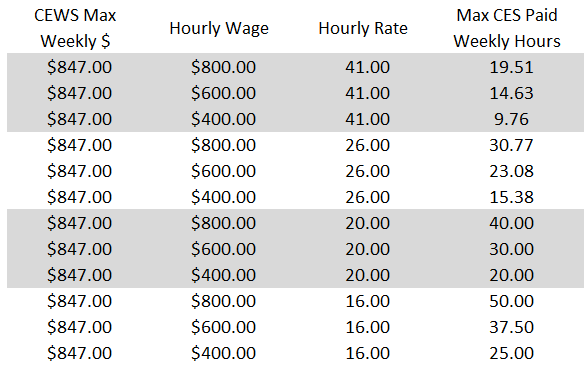

- If pre-pandemic pay is below $847 per week, then schedule them with the max hours below:

- Consider banking hours from one week to the next to avoid exceeding the $847. This would have to be agreed upon by Employees.

Should you include all employees in the program or leave some on EI/CERB?

- Legally, you are not required to include everyone.

- In determining who will be included and not here are some considerations.

|

Legal |

Practical |

|

No discrimination based standard factors (age, gender etc.) Banking hours across weeks is doable if the Employees agree.

|

What roles do you require? How much of each role? Would folks accept hours banking across weeks / are you okay to go above the CEWS maximum at all? Internal politics. Retention considerations. |

Are you required to include employees who will not accept work due to concerns about exposure to Covid-19?

Strictly speaking, no but this is a tricky area. Here are some considerations.

|

Legal |

Practical |

|

Employees can refuse unsafe work. Are you confident that your Covid-related H&S practices would stand up to a review? Are you an essential service? Can more be done to accommodate them? Ex. Work from Home |

Internal politics. Retention considerations. |