Design Your Plan for which You can afford Full Compliance

All mainstream plans have requirements in the contract for minimum participation levels of your eligible personnel – It’s typically above 75% and the smaller the employee base the higher the requirement and typical eligibility requirements are indefinite term (permanent) employees whose regular schedule meets or exceeds some number of hours per week (ex. 24, 35 etc.).

There are many risks to haphazardly applying benefits plans. Here are a few examples:

- An Employee could make a legal claim against their employer due to a long-term disability scenario that would have been covered had they been enrolled in the company benefits program for which they meet all eligibly requirements.

- The insurer balks at a major claim because the company has not fulfilled its contractual requirements to enroll all eligible employees. The Employee seeks compensation directly from the employer.

- A good employee leaves the company because their office mate -- who is in similar role with similar employment terms -- has benefits and they don’t.

So, it’s vital to design a plan for which you can afford to enroll every person in your organization who meets the eligibility requirements. We see rate increases in plans from year to year and so its also a good idea to leave space n your benefits budget to accommodate these future increases.

We have seen other solutions for companies who want to cherry pick who gets company-paid benefits, and can direct you to those if it is of interest.

You Need a Complete Company Policy on Group Benefits

It is necessary to publish for all employees the major tenets of the company’s’ benefits program. To this end, when we create your Company Policy on Group Benefits, it will include all relevant details of the plan to allow for a strong common understanding by all stakeholders (Company Leaders, Supervisors, Employees and WorkforcWins Client Specialists). See Appendix 1 for a sample policy.

Ways to Manage the Overall Cost of Your Plan

Your broker’s role is to help you design a program that works for your budget, today and down the line. Here are some strategies we’ve seen within our client-base to mange the cost.

Multiple Plans

Employing multiple plans can be a way to lower overall costs. Some companies offer a lower feature plan for some groups of employees (ex. frontline or newer staff) and a higher featured plan for others (ex. Management).

Cost-sharing

Adding cost-sharing to some or all plans is a common way to reduce costs.

Non-insured Coverages

Employing non-insured coverages (ex. Spending accounts) is a way to have more control over annual price increases.

Transitioning from One Program to Another

As your Benefits Plan Administrator, an important part of our service to our clients is managing the transition from one plan to another. Such transitions must be handled properly to avoid numerous legal risks and to ensure a clean, convenient transition process that has minimal impact on day to day operations. Moving from legacy plans can require a lot of sensitivity and creativity.

SAMPLE COMPANY POLICY ON GROUP BENEFITS

GROUP HEALTH BENEFITS AND INSURANCE

Applicability: Watch for Differences.

- Employees who work less than full-time hours are not eligible.

- Fixed-term Employees are not eligible.

- Seasonal Employees are not eligible.

- If an Employee is under a formal probationary process at the time of enrolment eligibility, they are not eligible until the probation period ends.

- For insured benefits, we are only required to pay our portion of the premiums with no further obligations. Eligibility for these benefits is determined by our current benefits provider. The Company has no responsibility for any claims that the benefits provider determines that the Employee is not eligible for.

- Benefits coverage may change from time to time. See the most recent version of the Employee Benefits Booklet for full details.

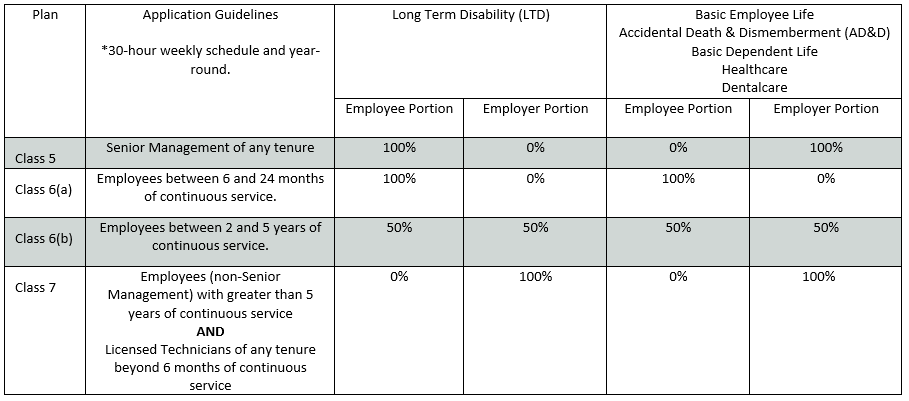

- Multiple classes of benefits are offered with different levels of benefits coverage and differing cost-sharing arrangements. The specific class in which the Employee is enrolled is based on role, tenure, and employment terms as outlined in the table below.

Benefits Coverage and Job Protected Leave

The company will maintain and continue to pay for all benefits for which they pay 100% of the cost. Employees may elect to pause any coverage for which they pay a portion. Premiums for the Employee portion of any coverage maintained on leave are the responsibility of the Employee. These may be paid by the Employer up front with arrangements to collect them from the Employee upon their return or collected up front from the Employee, at the company’s discretion.

Benefits Coverage and Changes to Terms of Employment

In the case where the terms of an Employee’s employment changes such that they no longer qualify for their current class of benefits, they will be automatically moved to any class that exists for which they are eligible. If their terms make them ineligible for all classes, they will cease to have benefits.

Opting Out of Extended Health Benefits Plan

In Canada, the insurance guidelines require employees to participate in the health benefits offered by their employer – even if the plan is 100% Employee paid. In fact, there are only two instances where insurance rules allow employees to opt out:

- Disability or maternity leave– If an employee cannot be physically present at work due to a leave of absence, they can opt out of their coverage during that time. Of course, in the event that they return to work, they must resume their coverage and contributions accordingly.

- Spousal or common-law coverage – Employees who are married, whether it be by common-law, to a person of the same sex, or to a person of the opposite sex, may have a spouse who is employed with a company that also offers employer-sponsored health benefits. If this employee’s spouse pays less money and has better coverage, then they may opt out of their own company’s plan in favor of the benefits offered by their spouse’s employer.

Opting Out Disability and Life Insurance

The insurance guidelines require all eligible employees to participate in the insurance benefits offered by their employer – even if the plan is 100% Employee paid.